Liposomes — a carrier technology that balances biocompatibility and high-efficiency delivery — have seen surging interest in recent years across pharmaceuticals, cosmetics, and dietary supplements. Their journey from lab research to commercial adoption reflects both technological maturity and real market demand. Today, we’ll break down the liposome industry’s present state and future trajectory by looking at R&D momentum, market size, segment trends, and more.

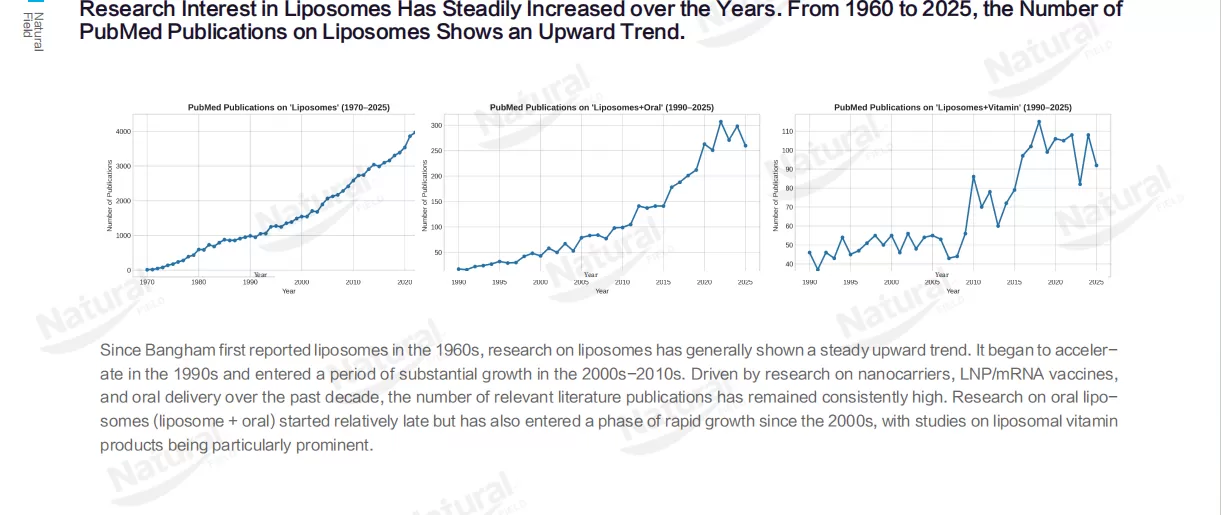

Since Bangham first reported liposomes in the 1960s, research interest in this technology has steadily climbed. PubMed data shows:

Growth picked up significantly in the 1990s, then boomed between 2000–2010.

Over the past decade, advances in nanocarriers, LNP/mRNA vaccines, and oral delivery tech have kept publication volumes consistently high.

Oral liposome research started later but took off in the 2000s; studies on “liposome + vitamin” products stand out as a key growth area — laying the groundwork for liposomes to move into consumer-facing products like dietary supplements.

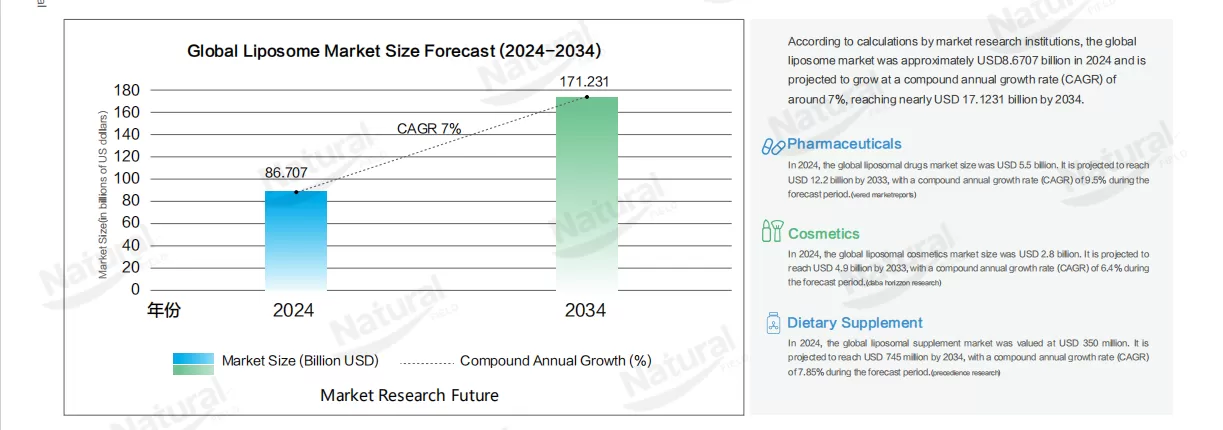

Market analysts project the global liposome market will hit $8.6707 billion in 2024, growing at a ~7% compound annual growth rate (CAGR) to reach nearly $17.1231 billion by 2034. Here’s how the top three sectors stack up:

Pharmaceutical Sector: $5.5 billion in 2024, projected to hit $12.2 billion by 2033 (9.5% CAGR — the fastest-growing segment).

Cosmetics Sector: $2.8 billion in 2024, set to reach $4.9 billion by 2033 (6.4% CAGR).

Dietary Supplement Sector: $350 million in 2024, expected to hit $745 million by 2034 (7.85% CAGR).

The liposome market’s growth story is taking shape around these key trends:

Product Types: Vitamin-based formulations (e.g., vitamin C) remain dominant; liposome products featuring glutathione, vitamin D, and other antioxidants are gaining traction quickly.

Functional Focus: Immune support leads (~24% of the market); cognitive support and anti-aging products are growing particularly fast.

Formulation Preferences: Liquid formulations are most popular (~41% share); capsules/softgels are also steadily gaining ground.

Distribution Channels: E-commerce leads (37–40% of sales); subscription models and DTC (direct-to-consumer) strategies are poised to be next-gen growth drivers.

Target Demographics: Adults make up ~59% of consumers; fitness enthusiasts and sub-healthy populations are emerging as high-growth groups.

The liposome market’s upward trajectory is fueled by strong momentum — but it faces meaningful hurdles too:

Key Drivers

Rising consumer health awareness: People are prioritizing “high-absorption” and “high-bioavailability” products.

Expanded scientific research: More evidence for liposome efficacy is building trust in the market.

E-commerce & DTC expansion: These models boost reach and engagement efficiency.

Aging populations, chronic disease management, and personalized nutrition: These trends are pushing the industry to evolve.

Key Headwinds

Elevated production costs: Liposome tech is pricey, limiting adoption in price-sensitive regions.

Limited clinical evidence: Some products lack robust data to back claims, which hurts consumer trust.

Fragmented regulatory standards: Cross-border marketing faces hurdles around labeling and functional claims.

As a 20-year veteran in nutritional ingredients, Natural Field released our Liposome White Paper in 2025 — a comprehensive guide to the tech’s use cases, safety data, and market potential. We build our liposome ingredients around the principle of “producing nutritional ingredients with pharmaceutical-grade standards”: our offerings carry nearly 10 domestic and international certifications (including FSSC 22000 and ISO), and our 32-person specialized R&D team (backed by 39 national patents) balances high bioavailability with product stability.

Today, our liposome products serve global leaders like Nestle and LG, with stable supply supported by strategic warehousing facilities in the U.S., UK, and beyond — reaching 86 countries and regions. If you need compliant, high-performance liposome ingredient solutions or customized formulation support, reach out to us: Natural Field’s expert technical support and flexible services will help your products ride the liposome market’s growth wave.